The Amanano Rural Bank PLC has recorded a gross profit of GHC842,127.00 in 2022, marking the first positive turn of fortune in over five years. This is a significant improvement from the trajectory of a loss of GHC1,941,434.00 recorded in 2021. This announcement was made at its 35th Annual General …

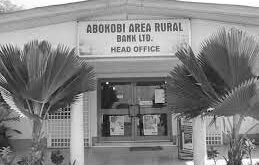

Read More »Abokobi Rural Bank posts 330% profit for 2021

The Abokobi Area Rural Bank Limited posted an impressive financial performance of GH¢400,328 for 2021 as against GH¢93,296 in 2020, representing an increase of 330.11per cent. The bank’s total assets rose from GH¢29.5 million in 2020 to GH¢35million in 2021, making an increase of 20 per cent while total deposits …

Read More »ARB Apex Bank records profit despite ravages of COVID-19

Despite the ravages of COVID-19, the Association of Rural Banks (ARB) Apex Bank Limited, has recorded the highest profit before tax (PBT) of GH₵5.9 million. This is an increase of 482 percent over the previous year, the highest PBT in more than 10 years. The Bank’s total operating income also …

Read More »Sekyere Rural Bank increases profit

The Sekyere Rural Bank at Jamasi in the Sekyere South District, made significant progress by increasing its profit before tax by 28 per cent. Dr. Francis Denteh, Chairman of the Board of Directors, told the shareholders at its 31st meeting at Kronom in the Suame Municipality that despite the challenges …

Read More »Mponua Rural Bank records GH¢1.56 million profit before tax

Mponua Rural Bank Limited has recorded a profit before tax of GH¢1.56 million for the 2019 financial year. Last year’s growth which represents 8.36 per cent was, however, lower than what was recorded the previous year which growth stood at 14.44 per cent. The drop in profit growth was attributed …

Read More »Have faith in community, rural banks – ARB Apex Bank’s Curtis Brantuo

The ARB Apex Bank has called on its shareholders, staff and boards of rural and community banks to work hard to put the banks on a stable footing. It has also urged rural and community banks to increase their shareholding and encourage the public to purchase shares from them. The …

Read More »Afram Community Bank’s profit drops

The Afram Community Bank (ACB) Limited recorded a profit of GH¢330, 348.00 in 2019 as against GH¢664,606.00 in 2018, showing a decrease of 54.35 percent. The bank’s income also reduced from GH¢2,577.207 in 2018 to GH¢2,451,315, representing a decrease of 4.88 per cent in the financial year under review. This …

Read More »Akyempim Rural Bank shareholders okay partnership with Amenfiman Rural Bank

Shareholders of Akyempim Rural Bank Limited have mandated the Board and Management of the Bank to continue partnership negotiations with Amenfiman Rural Bank for a turnaround of the Bank’s fortunes. The shareholders gave their mandate at an extraordinary meeting of the bank at its main office at Gomoa Dawurampong. This …

Read More » Ghana Banks – News about banks in Ghana, microfinance, savings and loans, rural banks Hub of financial sector information in Ghana

Ghana Banks – News about banks in Ghana, microfinance, savings and loans, rural banks Hub of financial sector information in Ghana